07-29-2015

07-29-2015

|

#14

|

|

Admin

Join Date: Oct 2003

Location: Sportsman's Paradise, LA.

Posts: 5,382

|

Re: Ted Cruz calls them out on the floor

Quote:

Originally Posted by jeremy1375

The import export bank didn't close as it continued to maintain it's current portfolio. It just couldn't take on new loans during that time. Wikipedia describes the import/export bank as " the bank finances and insures foreign purchases of United States goods for customers unable or unwilling to accept credit risk." You use words like "subsidize", and "give away" money. Do you have evidence of this?

Republicans used up all their bullets by continuously threatening government shut downs. If they want a chance at taking the presidency and holding both houses, they can't do that anymore. They have to pass bills to show they can do their job.

I have zero problem with how Mitch McConnell handled things. That is politics.

This article says Heidi Cruz took unpaid leave, not quit. Whatever the case, she is integrated with the too big to fail (aka - tax payer subsidized) banking world

http://www.bloomberg.com/news/articl...e-from-goldman |

So you are OK with a party leader lying to his party on purpose to sell them and you out?

http://mercatus.org/publication/bigg...ies-ex-im-bank

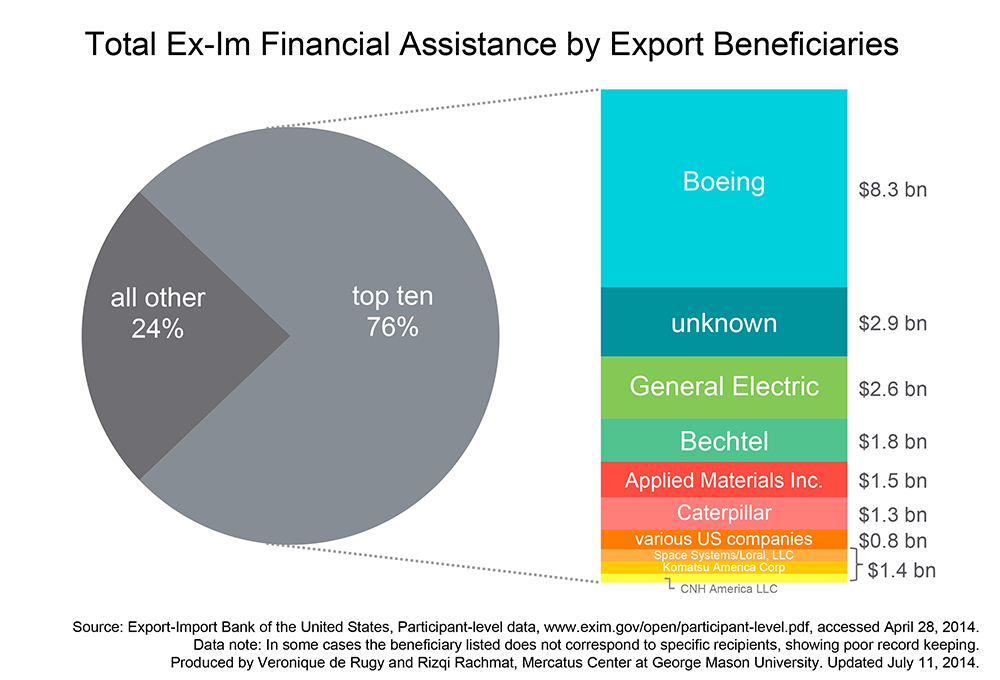

The first chart displays the top ten exporter beneficiaries for all combined Export-Import Bank interventions during FY 2013. The chart shows that the Bank truly lives up to its nickname, “Boeing’s Bank.” Boeing was by far the biggest exporter beneficiary of all Bank activity, raking in over $8 billion in assistance during FY 2013.

The Bank’s second top overall exporter beneficiary is alarming: the Bank’s data simply lists several exporters as “Unknown.” A later chart shows that most of these unidentified exporters benefit from insurance assistance. At least for now, almost $3 billion in Ex-Im activity cannot be accounted for with this dataset.

http://mercatus.org/publication/top-...rt-import-bank

The first chart displays the top ten exporter beneficiaries for all combined Export-Import Bank interventions during FY 2013. The chart shows that the Bank truly lives up to its nickname, “Boeing’s Bank.” Boeing was by far the biggest exporter beneficiary of all Bank activity, raking in over $8 billion in assistance during FY 2013.

The Bank’s second top overall exporter beneficiary is alarming: the Bank’s data simply lists several exporters as “Unknown.” A later chart shows that most of these unidentified exporters benefit from insurance assistance. At least for now, almost $3 billion in Ex-Im activity cannot be accounted for with this dataset.

http://mercatus.org/publication/top-...rt-import-bank

The number one buyer was the Mexican state-owned petroleum company, Pemex, which has a market capitalization of $416 billion but has somehow needed more than $7 billion in US-taxpayer-backed financing to facilitate deals with American exporters in recent years. Such assistance from the federal government to Pemex, along with other oil companies on the list, raises eyebrows, particularly considering that the current administration, which supports the reauthorization of the Ex-Im Bank, hasn’t exactly been pro-fossil fuels.

http://www.heritage.org/research/rep...rt-import-bank

Ex-Im Subsidies Threaten U.S. Jobs

The number one buyer was the Mexican state-owned petroleum company, Pemex, which has a market capitalization of $416 billion but has somehow needed more than $7 billion in US-taxpayer-backed financing to facilitate deals with American exporters in recent years. Such assistance from the federal government to Pemex, along with other oil companies on the list, raises eyebrows, particularly considering that the current administration, which supports the reauthorization of the Ex-Im Bank, hasn’t exactly been pro-fossil fuels.

http://www.heritage.org/research/rep...rt-import-bank

Ex-Im Subsidies Threaten U.S. Jobs

- The bank funnels billions of taxpayer dollars each year to overseas businesses for the purchase of American products. These subsidies put U.S. firms at a competitive disadvantage. Ex-Im financing of coal mining in Colombia, copper excavation in Mexico, and airplanes for India has been identified as contributing to job losses among domestic companies.

- Ex-Im officials fail to properly consider the impacts of export subsidies on American workers and the businesses that employ them. The Ex-Im Inspector General concluded that the bank’s analyses ignored economic impacts contemplated by the Ex-Im charter and omitted relevant data.

Ex-Im Puts Taxpayers at Risk

- All Ex-Im financing is backed by the “full faith and credit” of the U.S. government. Taxpayer exposure will exceed $140 billion by the end of FY 2014.

- The Congressional Budget Office recently reported that Ex-Im will operate at a deficit of $2 billion in the next decade (in addition to the bank’s operating costs).

- The Inspector General has concluded that the bank lacks sufficient policies to prevent waste, fraud and abuse, and has inadequate risk management policies and recordkeeping. Ex-Im Benefits Unfriendly Nations

- Ex-Im subsidies benefit China, Venezuela, Cuba, and Russia. State-owned foreign airlines have received $16 billion in subsidized financing since 2009.

http://www.heritage.org/research/rep...-american-jobs

The Export–Import Bank (Ex–Im) funnels billions of taxpayer dollars each year to overseas businesses for the purchase of American products. This subsidized financing is supposedly a win-win proposition for exporters and their customers abroad. But rare is a subsidy that does not produce disparity elsewhere. In the case of Ex–Im, the losers include domestic companies that are left to compete against foreign firms bankrolled by the U.S. government.

__________________

"You don't have a clue. You couldn't get a clue during the clue mating season in a field full of horny clues if you smeared your body with clue musk and did the clue mating dance."

When she get's bitchy, SPANK THAT ASS! (#Y#)

|

|

|